do closed end funds have liquidity risk

With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund. Both charge an annual expense ratio for their services.

What Is The Difference Between Closed And Open Ended Funds Quora

Closed-end funds CEFs can be one solution with yields averaging 673.

. Liquidity Risk Although CEFs are listed and traded on an exchange the degree of liquidity or ability to. Closed-end funds do not have this restriction. Unlike open-end funds managers are not allowed to create new shares to meet demand from investors.

Learn more about what. Their yields range from 632 on average for bond CEFs to. Initial offering Like a company going public a closed-end fund will.

The value of a CEF can decrease due to movements in the overall financial markets. The Closed-End Fund Structure Has Significant Advantages CEFs have a superior wrapper that helps to provide some advantages to the holder if they can be taught how to weather the added price risk. This can result in.

Industry regulations limit the amount of leverage that a fund can assume but some funds use leverage much more aggressively than others. Closed-End Funds and Liquidity Open-ended funds have no limit on the number of shares they can issue and capital flows into and out of the funds freely as new shares are issued and repurchased. What investors need to know about fund liquidity risk and what they can do about it.

A CEF or a closed-end fund is an investment fund that raises money through an IPO and then sells shares on the open market. Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. A closed-end fund CEF is a type of mutual fund where investors pool their money and a professional money management team oversees the portfolio by selecting the underlying stocks bonds and other securities.

Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. Closed-end funds have the ability subject to strict regulatory limits to use leverage as part of their investment strategy.

The use of leverage allows a closed-end fund to raise additional capital which it can use to purchase more assets for its portfolio. A closed-end fund is a public indirect pooled investment vehicle. This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and ability to make distributions to shareholders.

What Are Closed-End Funds. A closed end fund is just like a mutual fund or an exchange traded fund in that a manager buys and sells investments and investors can buy an ownership stake in the whole portfolio. Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility.

Changes in interest rate levels can directly impact income generated by a CEF. You can learn more about the different types of. Unlisted closed-end funds also provide limited liquidity.

Just like open-ended funds closed-end funds are subject to market movements and volatility. When investing in closed-end funds financial professionals and their investors should first consider the individuals financial objectives. Closed-end funds operate more like ETFs in that they trade throughout the day on a stock exchange.

Most but not all closed-end funds have the ability to use leverage in an attempt to enhance returns. Since closed-end funds are a much smaller asset class than open-end mutual funds ETFs and stocks some of them have much less trading liquidity. New SEC Rule Requires Open-End Funds to Have Formal Liquidity Risk Management Programs.

In exchange for this ease of investing the manager and investment company charges an annual fee called an expense ratio that gets deducted each year directly from. Both make distributions of income and capital gains to their shareholders. This flexibility means closed-end funds possess the ability to invest in less liquid companiescompanies that may offer growth potential over the.

In other words it could be harder to buy and sell the stock at desirable prices depending on how many people are willing to take the other side of your trade. Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small percentage of shares. Closed-end funds have the ability to use leverage which can lead to greater risk.

Closed-end funds and open-end mutual funds have many similarities. This lack of liquidity is a real cost when buying and selling assets especially during times of market stress and efficient markets practitioners like Malkiel would suggest that the closed-end fund discount is the true cost of the liquidity of getting in and out of these funds. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on demand.

However CEF discounts and leverage. Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says. When the Investment Company Act was enacted it was understood that redeemability meant that an open-end fund had to have a liquid portfolio.

Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage. Closed-end funds often use leverage which can increase the funds volatility ie risk.

Closed End Fund Fs Investments

What Is The Difference Between Closed And Open Ended Funds Quora

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

What Are Mutual Funds 365 Financial Analyst

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed End Fund Definition Examples How It Works

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

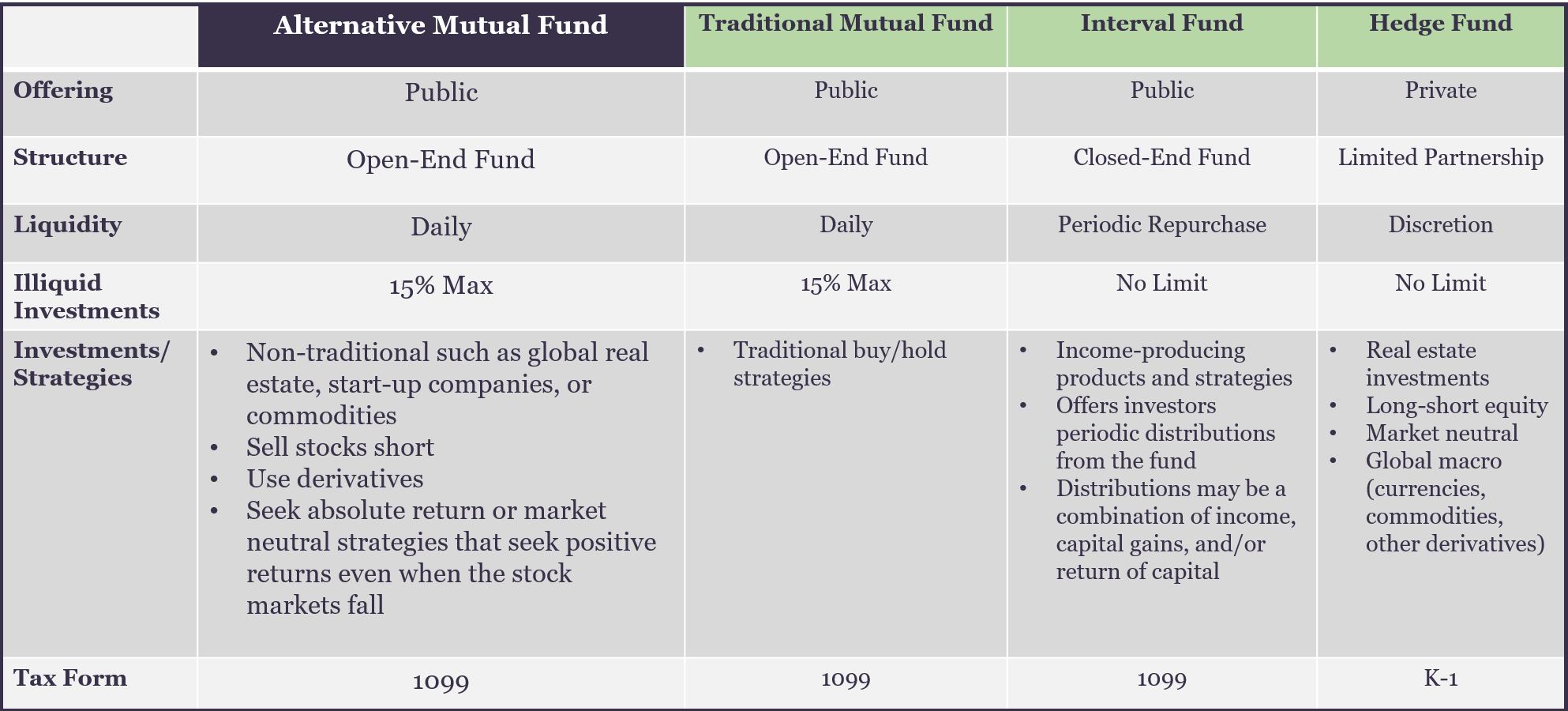

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

Investing In Closed End Funds Nuveen

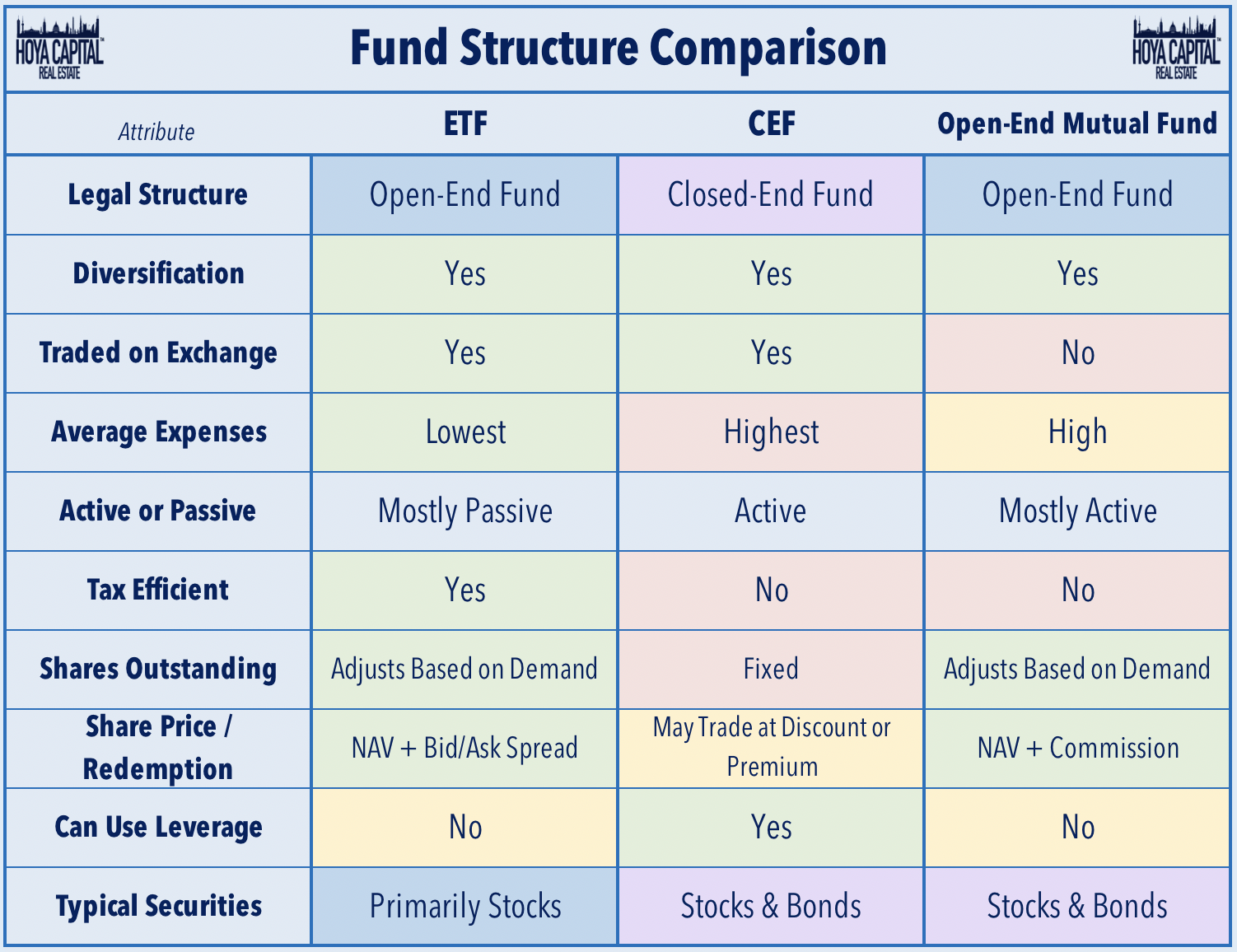

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Understanding Interval Funds Griffin Capital

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Pdf A Liquidity Based Theory Of Closed End Funds

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer